90 Days BEFORE Filing Bankruptcy/Preparing for Bankruptcy

If your plan is to open some new credit cards, buy some non-essential items, and file bankruptcy, stop here. Credit card purchases 90 days before your bankruptcy is filed can be deemed fraudulent, and you will have to prove that you reasonably intended to repay your debts. Otherwise, you may still have to repay these debts.

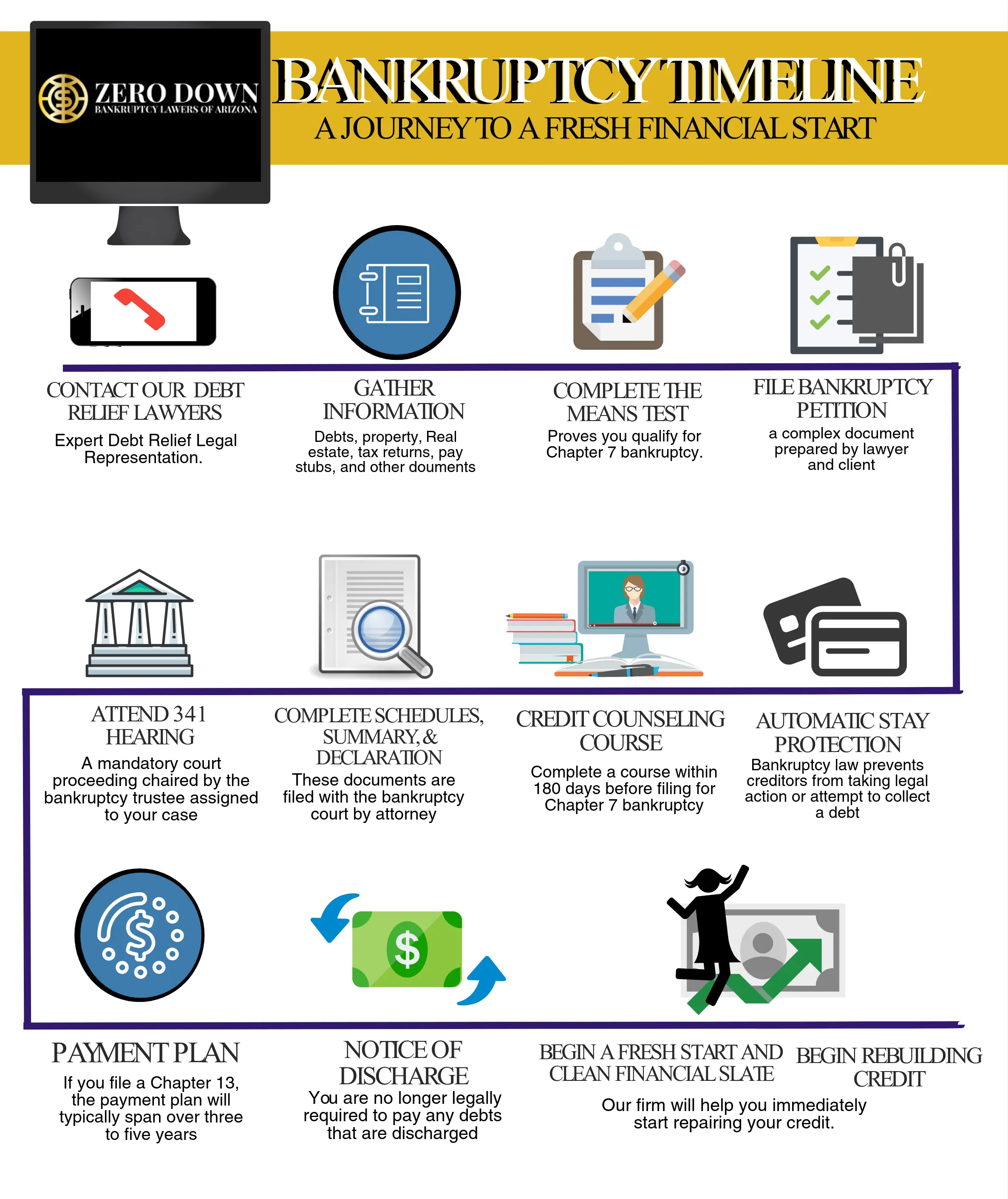

You should also be reaching out to attorneys and scheduling consultations. Even if you are planning on filing without an attorney, or pro se, an attorney will be able to provide you with valuable information and may be able estimate your chance of success filing pro se based on the complexity of your case. Many attorneys offer consultations free of charge. They will also be able to provide you with a list of documents you’ll need to assemble your petition. Do not procrastinate on gathering your documents. If you are behind on your taxes, catch up now. You don’t want to be filing back taxes while also dealing with a bankruptcy.

Debtor Education Class (Need to take the 1st Class)

Before your case is filed, you will need to take a credit counseling course. While there are other options available, most filers choose to take the course online. As some course providers require you to converse with a counselor telephonically, you shouldn’t wait until the day of your filing appointment to take your class. You may experience technical difficulties, not be available for a phone call, or have issues with time-stamping on the course certificate.

If you took the course in preparation for bankruptcy but delayed filing for some reason, your course certificate will be valid for 180 days.

Filing Your Case and The Automatic Stay

Once your case is filed, the Automatic Stay goes into effect. The Automatic Stay prevents creditors from collecting on your debts during your bankruptcy. Some of these methods you will be protected against are wage garnishment, foreclosure, and repossession. The Automatic Stay will remain in effect until your case is discharged or dismissed.

If your wages are being garnished for a dischargeable debt, the garnishment will be stopped permanently unless your case is dismissed. If your wages are being garnished for a non-dischargeable debt, the garnishment will only be temporarily paused until your case is dismissed. The Automatic Stay will operate as a delay for foreclosures and repossessions as well.

15 Days After Filing

This is about when you should receive a letter from your trustee. More likely than not, the trustee will request additional documentation from you. You should provide them with the information in the manner they request.

In a Chapter 13 bankruptcy, you will need to submit a proposed payment plan within 15 days of filing. You will also need to make your first payment, regardless of if the plan is confirmed, within 30 days of filing.

30-45 Days After Filing / 341 Meeting of Creditors

Your 341 Meeting of Creditors will be held approximately 30-45 days after your bankruptcy is filed. Be sure to bring your driver’s license and social security card. Do not bring copies or photos of these forms of identification. If you don’t have either of these, a passport or other governmental photo i.d. will work in lieu of your driver’s license. Bring an original W-2 form if you don’t have your social security card.

If you hire an attorney, they will be at your 341 hearing with you. Your attorney should prepare you for the types of questions the trustee will ask you beforehand. This won’t be an episode of Law & Order- these hearings are typically quick. Remember that it is still a court procedure, but you don’t need to go out and buy a suit either. Try your best to find alternative arrangements for the day if you are your children’s primary caregiver.

60-90 Days After 341 Hearing

After you attend your 341 Meeting of Creditors, you need to take a second credit counseling course. You must take it within 60 days of your 341 Hearing. Your attorney will file your completion certificate with the court so it can proceed with your discharge. In a Chapter 7, your case is eligible for discharge 60 days after your 341 Meeting of Creditors.

If you are in a Chapter 13 Bankruptcy, you will also be waiting for your plan to be confirmed. This process can vary drastically in length if your creditors file objections to your plan.

3-5 Years after Filing Chapter 13 Plan

Once you complete the previous steps of a Chapter 13 bankruptcy, you simply continue your payment plan until discharge. If you make below the median income level for your family size, your payment plan will be 3 years. If you make above the median income level, your plan will be 5 years.

You may want to convert your Chapter 13 to a Chapter 7 down the road. You may have needed to file bankruptcy less than eight years after a previous Chapter 7 bankruptcy, or experienced a drastic change in income.

Discharge

After discharge, a Chapter 7 bankruptcy will remain on your credit for 10 years. This won’t prevent you from opening new lines of credit. Many of our clients finance a new vehicle the day after they file. You should receive offers for new credit cards when your case is discharged. You will be eligible for a home loan after 2 years.

A Chapter 13 bankruptcy will remain on your credit for 7 years. You will need to get permission from the court to incur new debts (e.g., credit cards) during the life of your payment plan.

Contact our Arizona Bankruptcy Attorney for More Information

If you are looking for more information regarding a Bankruptcy Timeline, contact our Arizona Bankruptcy Attorney. Reach our lawyers at (602) 609-7000. Find out the details about chapter 7 bankruptcy and Chapter 13 bankruptcy and how it pertains to the bankruptcy timeline.