Despite being a legitimate legal procedure whose history spans back hundreds of years, bankruptcy is often looked down upon as “embarrassing” or “wrong.” Until you or someone you know is forced to file for bankruptcy for circumstances out of their control, you may have never had to stop and think about why bankruptcy might not actually be such a bad thing.

Is It Bad to File Bankruptcy?

You should check which chapter of bankruptcy you qualify for before you make a generalization about bankruptcy, because each chapter operates differently. You may only qualify for Chapter 13, which is a 3-5 year reorganization of your debts into a payment plan. The completed plan will always pay out fees to the attorney and trustee, secured debts, and priority debts. Unsecured nonpriority debts like credit cards and medical bills may be discharged after only partial payment in the plan. These types of creditors usually have measures in place to account for bankruptcy filings and avoid heading to bankruptcy court themselves.

In Chapter 7, most debts are wiped clean without repayment. There are strict income limits in Chapter 7 so that only people who really need it can use it. You will need to prove that debts incurred in the time immediately preceding your bankruptcy were not fraudulently incurred, or taken out with the intention of discharging in bankruptcy. You must include all of your debts in Chapter 7, including loans from friends and family members. If you find it morally wrong to discharge this type of debt in bankruptcy, you should consider Chapter 13 or another option. The trustee will raise issues in your case if payments to relative creditors are discovered.

Can It Be Good to File Bankruptcy?

One reason people may be reluctant to file bankruptcy is that it will follow you for years by remaining on your credit report. A Chapter 7 bankruptcy will remain on your credit for 10 years from the date of filing, and a Chapter 13 bankruptcy will remain on your credit for 7 years from the filing date.

Having a bankruptcy on your credit can make it more difficult to get approved for new lines of credit, and you won’t be able to mortgage a new home for at least 2 years after the date your bankruptcy petition is filed. However, missed payments, judgments, and wage garnishments can all have a similar effect on your financial situation. A bankruptcy’s impact on your credit will depend on the state of your credit before the bankruptcy, and which chapter you file. While those with good credit may see a decrease in their score after filing, more often we see clients with moderate to low credit scores. When that is the case, the filer’s score may change only very slightly, or may even increase upon filing. Either way, there are many steps one can take after bankruptcy to rebuild credit.

Why Does Bankruptcy Have Such a Bad Reputation?

Only Poor People File Bankruptcy

Some chapters of bankruptcy, such as Chapter 13 bankruptcy, are designed to help people who have a stable income but have gotten over their head in debt.

There is a long list of famous, rich, and successful people who have filed bankruptcy, either individually or for a business, including:

- Walt Disney

- Abraham Lincoln

- Donald Trump

- Marvin Gaye

- David Bowie

- Wayne Newton

- Ulysses S. Grant

- Milton Hershey

- Joe Lewis

- Henry Ford

- Francis Ford Coppola

- Thomas Jefferson

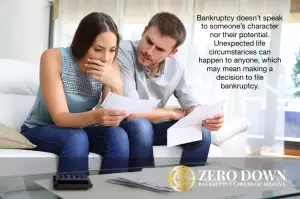

This goes to show that bankruptcy doesn’t speak to someone’s character nor their potential. It also shows that unexpected life circumstances can happen to anyone, which may mean eventually filing bankruptcy.

5 Reasons You Shouldn’t File Bankruptcy

- Your friends and family may not be repaid in Chapter 13- These creditors will be at the bottom of the list of creditors to be repaid in bankruptcy, so they may receive partial payment or no payment at all. These debts are discharged in Chapter 7, so they will receive no repayment if you file under this chapter.

- You can stop creditor calls without filing bankruptcy- One benefit of bankruptcy is that your creditors must stop contacting you as soon as you inform them you have retained a bankruptcy attorney. However, you can send your creditors a letter stating that you no longer wish to receive calls and letters per the Fair Debt Collection Practices Act.

- Some accounts can be removed off of your credit- You can dispute accounts on your credit report and may have some removed. Medical bills are one of the easiest debts to have removed from your credit.

- There may be a better alternative to bankruptcy for you- You should speak to an attorney about if debt consolidation or debt settlement may be better for your situation.

- You may be able to rebuild your credit more effectively without bankruptcy- Settling accounts, paying off debts, and making timely payments on new lines of credit may help your credit more effectively than bankruptcy.

Have more questions about bankruptcy? Want to learn more on Filing Bankruptcy in Arizona with Zero Down? Call to schedule your free consultation today. (602) 609-7000.